Content

For example, state laws may require a corporation to restrict a portion of its retained earnings equal to the cost of its treasury stock. By default, a corporation’s retained earnings can be used for whatever purpose its management/board of directors decides on. As such, an established corporation is more inclined to distribute its net income as dividends to its shareholders.

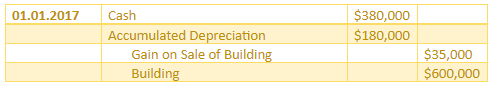

The important thing to note here is that we’re reducing the total asset value by crediting current depreciation. This leads to an imbalance on the balance sheet that must be corrected. For example, imagine our wholesale watch company purchases a metal working machine.

Know How Much You Can Invest With Retained Earnings

For example, sales returns and allowance and sales discounts are contra revenues with respect to sales, as the balance of each contra is the opposite of sales . To understand the actual value of sales, one must net the contras against sales, which gives rise to the term net sales . Typically, businesses record their retained earnings on a balance sheet. A balance sheet is a financial statement made up of total assets, liabilities and owner’s equity. Assets are the items of value that you own; liabilities are what you owe; and equity is the money you have left after paying down debts. The first entry closes revenue accounts to the Income Summary account. The second entry closes expense accounts to the Income Summary account.

With double-entry accounting, the accounting equation should always be in balance. In other words, not only will debits be equal to credits, but the amount of assets will be equal to the amount of liabilities plus the amount of owner’s equity. A retained earnings balance is increased when using a credit and decreased with a debit.

Understanding The Cash Flow Statement

Define accrued expenses and revenues, explore the types of accrued expenses and revenues, and examine practical examples of these two concepts. No matter how you decide to use your retained earnings, it’s important to keep your books straight and make sure you report all income and expenses in the right place. However, unlike retained earnings, revenue is reported as an asset on the balance sheet. Now, let’s say you’ve struggled a bit this year and your retained earnings are in the negative. You have beginning retained earnings of $12,000 and a net loss of $36,000. If you’re a new business, put in a $0 for retained earnings, and if your retained earnings were in the negative, make sure to mark that as well. You could have negative retained earnings if you have a net loss and negative or low previous retained earnings.

What is retained earnings with example?

Retained earnings are the net income that a company retains for itself. If your company paid out $2,000 in dividends, then your retained earnings are $1,600.

We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Any dividends you distributed this specific period, which are company profits you and the other shareholders decide to take out of the company. When you issue a cash dividend, each shareholder gets a cash payment. The more shares a shareholder owns, the larger their share of the dividend is. There is no requirement for companies to issue dividends on common shares of stock, although companies may try to attract investors by paying yearly dividends. Stock dividends are payments made in the form of additional shares paid out to investors.

Net Profit And Retained Earnings Do Not Entirely Represent Cash

A corporation’s management/board of directors can decide to declare and distribute all of its earnings as dividends, and it still wouldn’t be violating any laws. In the event of liquidation or bankruptcy, the whole amount of retained earnings would be used to settle the financial obligations of the corporation . Discretionary restrictions are those decided upon by the corporation’s management/board of directors. For example, if there is a planned expansion, the board of directors may decide to restrict a portion of its retained earnings to fund the expansion.

Boasting A 31% Return On Equity, Is TTEC Holdings, Inc. (NASDAQ:TTEC) A Top Quality Stock? – Nasdaq

Boasting A 31% Return On Equity, Is TTEC Holdings, Inc. (NASDAQ:TTEC) A Top Quality Stock?.

Posted: Wed, 01 Dec 2021 17:07:11 GMT [source]

If you are a new business and do not have previous retained earnings, you will enter $0. And if your previous retained earnings are negative, make sure to correctly label it. The balance in Retained Earnings agrees to the Statement of Retained Earnings and all of the temporary accounts have zero balances. We now close the Distributions account to Retained Earnings. Distributions has a debit balance so we credit the account to close it. Our debit, reducing the balance in the account, is Retained Earnings.

Are Retained Earnings The Same As Reserves?

The figure from the end of one accounting period is transferred to the start of the next, with the current period’s net income or loss added or subtracted. It is also possible that a change in accounting principle will require that a company restate its beginning retained earnings balance to account for retroactive changes to its financial statements. This will alter the beginning balance portion of the formula. Because all profits and losses flow through retained earnings, essentially any activity on the income statement will impact the net income portion of the retained earnings formula. Close income summary to the owner’s capital account or, in corporations, to the retained earnings account.

In short, retained earnings are the cumulative total of earnings that have yet to be paid to shareholders. These funds are also held in reserve to reinvest back into the company through purchases of fixed assets or to pay down debt. The process of using debits and credits creates a ledger format that resembles the letter “T”. The term “T-account” is accounting jargon for a “ledger account” and is often used when discussing bookkeeping. The reason that a ledger account is often referred to as a T-account is due to the way the account is physically drawn on paper (representing a “T”). The left column is for debit entries, while the right column is for credit entries. Equity accounts record the claims of the owners of the business/entity to the assets of that business/entity.Capital, retained earnings, drawings, common stock, accumulated funds, etc.

How Are Retained Earnings Different From Revenue?

When an accountant closes an account, the account balance returns to zero. Starting with zero balances in the temporary accounts each year makes it easier to track revenues, expenses, and withdrawals and to compare them from one year to the next. There are four closing entries, which transfer all temporary account balances to the owner’s capital account. Each of these accounts must be zeroed out so that on the first day of the year, we can start tracking these balances for the new fiscal year.

For example, before a creditor grants you a loan, they might require your corporation to restrict a portion of your retained earnings. Unlike unrestricted retained earnings, restricted retained earnings t account retained earnings cannot be used for the distribution of dividends . This way, the creditor is more assured that the corporation would likely have funds to pay off the loan.

You will be left with the amount of retained earnings that you post to the retained earnings account on your new 2018 balance sheet. If so, this negative balance is called an accumulated deficit. It is quite possible that a company will have negative retained earnings. Investors are especially wary of a negative retained earnings balance, since it can be an indicator of impending bankruptcy. Close the income statement accounts with credit balances to a special temporary account named income summary.

Study the definition, examples, and types of accounts adjusted such as prepaid and accrued expenses, and unearned and accrued revenues. Technically, shareholders can claim the money in the retained earnings account.

The time is now to get a head start and prepare for the upcoming tax season with these necessary January tax steps. Getting familiar with common accounting terms can make it easier to get ahead of business finances, and get you back to business faster.

Revenue is income, while retained earnings include the cumulative amount of net income achieved for each period net of any shareholder disbursements. The third entry requires Income Summary to close to the Retained Earnings account. To get a zero balance in the Income Summary account, there are guidelines to consider. The reserve account is drawn from retained earnings, but the key difference is that reserves have a defined purpose, like paying down an anticipated future debt. Keir Thomas-Bryant Keir is Sage’s dedicated expert in the small business and accountant fields. With over two decades of experience as a journalist and small business owner, he cares passionately about the issues facing businesses worldwide. Sage 50cloud Desktop accounting software connected to the cloud.

Reinvestment Of Retained Earnings

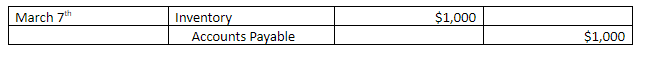

A purchases journal is a specialized type of accounting log that keeps track of orders made by a business ~’on credit~’ or ~’on account.~’ Learn more on the definition and see examples. A key aspect of proper accounting is maintaining record of expenses through Source Documents, paper or evidence of transaction occurrence. See the purpose of source documents through examples of well-kept records in accounting. A classified balance sheet or a Statement of Financial Position, contains information on the financial position of a business. Study the definition and example of a classified balance sheet, and how it shows what a business owns, owes, and is worth. Post the closing entries to Income Summary and Retained Earnings. Deciding how to invest net income is an essential task for any small business owner and retained earnings can tell you how much you’re working with before you make any major investments.

Income Summary allows us to ensure that all revenue and expense accounts have been closed. We need to complete entries to update the balance in Retained Earnings so it reflects the balance on the Statement of Retained Earnings.

How do you record retained earnings?

Retained earnings should be recorded. Generally, you will record them on your balance sheet under the equity section. But, you can also record retained earnings on a separate financial statement known as the statement of retained earnings.

To calculate RE, the beginning RE balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted. A summary report called a statement of retained earnings is also maintained, outlining the changes in RE for a specific period. Now that the revenue account is closed, next we close the expense accounts.

You could also elect to record retained earnings on separate statement of retained earnings. Why was income summary not used in the dividends closing entry? Only income statement accounts help us summarize income, so only income statement accounts should go into income summary. Now, if you paid out dividends, subtract them and total the Statement of Retained Earnings.

- You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

- Despite the use of a minus sign, debits and credits do not correspond directly to positive and negative numbers.

- What happens instead is a redistribution of equity, from retained earnings to share capital.

- Therefore, these accounts still have a balance in the new year, because they are not closed, and the balances are carried forward from December 31 to January 1 to start the new annual accounting period.

- Thus, when the customer makes a deposit, the bank credits the account (increases the bank’s liability).

- The statement of retained earnings is a financial statement entirely devoted to calculating your retained earnings.

When you own a small business, it’s important to have extra cash on hand to use for investing or paying your liabilities. But with money constantly coming in and going out, it can be difficult to monitor how much is leftover. Use a retained earnings account to track how much your business has accumulated.

Author: Kim Lachance Shandro