Content

- Bill Com Vs Quickbooks Online: Features

- Research & Ratings Bill Com Holdings Incbill

- Share Price And Profitability Of The Share Bill Com Billcom

- Why Bill Com Stock Jumped 33% In August

- Bill Com’s Partnerships And Growth Make This Company Shine

- Analyst Price Target On Bill

- Does Bill Com’s Stock Price Have Much Upside?

The chart below shows how a company’s ratings by analysts have changed over time. Each bar represents the previous year of ratings for that month.

Upgrade to MarketBeat Daily Premium to add more stocks to your watchlist. Lets you give your clients flexibility on how to settle their accounts. He is an investor that has developed his methods from the likes of Motley Fool greats like David and Tom Gardner. He primarily focuses on high-growth, moderate-risk companies that could experience multi-bagger growth over the next 10 years.

Bill Com Vs Quickbooks Online: Features

Merchant Maverick’s ratings are not influenced by affiliate partnerships. I like that the platform is in the cloud and accessible from any computer or mobile device. It makes it easier to pay bills in a quick and efficient manner. Gone are the days of having to be in the office to review invoices and sign printed checks. I can review each invoice in a slideshow, approve or deny and even add comments.

The downside to all this growth is that the company is losing a lot of money. The company’s Q1 net loss was $75 million — or 87% of gross profit, which was driven by operating expenses more than tripling year over year.

Research & Ratings Bill Com Holdings Incbill

Tim Yoder is a subject matter expert at Fit Small Business focusing on small business bookkeeping, accounting, and tax content. Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor for both the Online and Desktop products, as well as a CPA with 25 years of experience. He most recently spent two years as the accountant at a commercial roofing company utilizing QuickBooks Desktop to compile financials, job cost, and run payroll. Bill Pay for QuickBooks Online allows you to pay and track bills from your QuickBooks Account.

Is online bill pay safe?

Online bill paying is safe when you choose the right bill payment service. Typically, an online bill pay service that is backed by a bank or a company that provides online banking services will be safe and reliable. Online bill paying is much safer, for example, than handing a credit card to a waiter at a restaurant.

Bill.com is an advanced bill payment solution for businesses that helps to manage the financial operations of small and mid-size companies. The software integrates and shares financial data with the user’s accounting system. Bill.com runs Accounts Payable and Accounts Receivable functions remotely for users and offers a smart way to create and pay bills, send invoices and get paid by the customers. It increases efficiency and saves users’ time by automating the entire work. Companies can set up approval workflows and custom roles that suit their team. The platform accepts international payments across various countries and currencies. Bill.com uses industry-standard Transport Layer Security to protect the data in transit.

Share Price And Profitability Of The Share Bill Com Billcom

An automated accounting solution can help you streamline your back office. It is one way to get paid more quickly and to efficiently settle accounts.

Spire natural gas prices increasing after cost adjustment review – KSDK.com

Spire natural gas prices increasing after cost adjustment review.

Posted: Tue, 30 Nov 2021 00:00:34 GMT [source]

They processed an international payment, showed it as “cleared” and then held it for several weeks forcing me to provide additional information on the payment. The vendor never received it and I have still not received the funds back over 2 weeks later. Be careful using their systems as they can hold your funds and really mess up your cash flow. Import bill com price and export files to keep bills, invoices, and payments up to date. Bill.com’s packages are scalable for different sized businesses and offer a range of useful features. All plans include standard approval workflow, unlimited document storage, and payment support. Bill.com is not accredited with the Better Business Bureau, but it has an A rating.

Why Bill Com Stock Jumped 33% In August

Intraday data delayed at least 15 minutes or per exchange requirements. Sign up for Lab Report to get the latest reviews and top product advice delivered right to your inbox. The screen that lies beneath this window includes a link called Bill Details. Hover over it, and a list opens containing your options there.

- The leading small business accounting websites like QuickBooks Online and Xero (Visit Site at Bill.com) have tools for managing bills.

- In May 2019, Bill.com introduced the Bill.com Intelligent Business Payments Platform which uses artificial intelligence to provide end-to-end workflow automation to streamline the payments process.

- Bill.com integrates directly with accounting software so that all data between the two programs is synced.

- Having used Bill.com for some time now, I am constantly strategizing how to unwind from this morass.

- Moody’s Daily Credit Risk Score is a 1-10 score of a company’s credit risk, based on an analysis of the firm’s balance sheet and inputs from the stock market.

- Bill.com is unique in that it unites businesses, accountants, and banks in business payments.

Your review has gone for moderation and will be published soon. MYOB is designed locally, for local businesses, working with the ATO so you’re always up-to-date…. Sage Accounting software aims at providing information, insight and tools to small and medium… The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Pay your employees back quickly and efficiently using our seamless expense management tool. Unlike Bill.com, Corpay One doesn’t charge subscription fees or document scanning fees.

Bill Com’s Partnerships And Growth Make This Company Shine

Jamie looks for innovative companies that are disrupting their respective industries and have the potential to create a new industry standard. Let’s talk about how your product can solve the business needs of our visitors. Second, you must assign approvers for each bill and allocate departmental expenses. Multiple employees can be setup to approve bills simultaneously, if needed.

- Approve, explore or decline expenses, with easy, accurate invoice and receipt uploads.

- If your business works with 1099 contractors, you’ll find that QuickBooks gives you the ability to track 1099 payments and process 1099s.

- We’re impressed with the straightforward tools inside Bill.com that lets your business keep tabs on accounts payable and receivable with ease.

- Bill.com is an excellent standalone website that automates accounts receivable and payable and can be integrated easily with QuickBooks Online and Xero.

- This software is also great for companies looking to move their billing processes to the cloud (so that they don’t have to print checks, send checks, wait for checks to arrive, etc.).

Bill.com Holdings Inc. provides a cloud-based software for back-office financial operations for small and midsize businesses . Through its platform customers can view their cash in-flows and outflows as well as bills coming due. It also offers various payment services, including automated clearing house Payments, card payments, real-time payments , checks, cross-border payments. Its product offers solutions for accounts payable, accounts receivable and international payments.

Analyst Price Target On Bill

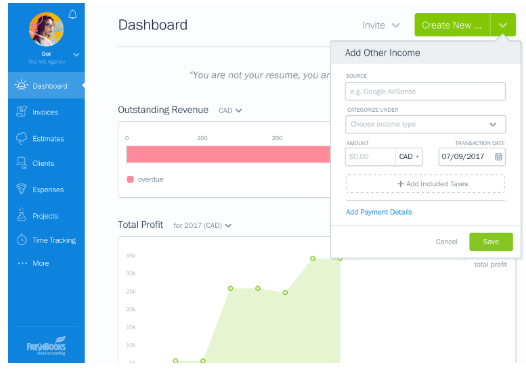

Because of its limited integrations, Bill.com is better served as an integration itself as it can be connected to several accounting software packages. QuickBooks integrates with more than 650 apps and also has two built-in integrations to streamline your payroll and time tracking. Below is a view of the Bill.com Dashboard for Corporate and Enterprise plans, which you will see when you log into the program.

Take a look at our post on the top free invoicing software options to learn more. Although, if you only need basic invoicing and predominantly want bill management, Bill.com could still be a good choice. While Bill.com does offer invoicing features, the accounts receivable side of the software is severely lacking, especially compared to other companies like Zoho Invoice and Invoicera. The accounts payable feature is the star here, and it is excellent. When it comes to automating bill payments, Bill.com can’t be beaten — especially considering the software’s recently redesigned UI. Further, Bill.com reviews show that customers are satisfied overall with what this software has to offer.

Does Bill Com’s Stock Price Have Much Upside?

Found this out after an hour-long, extremely frustrating help-chat. Business owners looking to save time on paying bills need to know about Bill.com.

Bill.com Holdings, Inc. (BILL) CEO Rene Lacerte on Q1 2022 Results – Earnings Call Transcript – Seeking Alpha

Bill.com Holdings, Inc. (BILL) CEO Rene Lacerte on Q1 2022 Results – Earnings Call Transcript.

Posted: Thu, 04 Nov 2021 07:00:00 GMT [source]

Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade. You may decide, for example, that some bills don’t need to be approved and can simply be paid. Your policies may also mandate that bills greater than or equal to a specified dollar amount must have a given number of approvers. Danielle is a writer for the Finance division of Fit Small Business. She has owned a bookkeeping and payroll service that specializes in small business, for over twenty years. Fit Small Business content and reviews are editorially independent. “The filtering of invoice views seems a little misunderstood by some of our staff at times.”

How long does Bill com take to process?

ePayments (ACH) will arrive within 3 days of the process date. The process date is the day we debit funds from your bank account to fund a payment. For Bill.com customers who have made 5 or more payments previously, qualifying payments under $10,000 will arrive the next banking day after the process date.

As such, it has become a trusted partner of several of the largest financial institutions in the U.S., including top accounting firms and popular accounting solution providers. With Bill.com you can receive digital invoices from vendors and ensure rapid approval. Similarly, you can create and issue invoices to your customers and receive settlement through ACH, ePayment, Paypal or credit card. The platform syncs easily with major accounting software like Oracle, Xero, QuickBooks and Sage.

Author: Michael Cohn