This process can significantly impact inventory management, as it ensures that products are accurately categorized, providing a clear overview of available stock and sales trends. Expense tracking also benefits from this reorganization, as it enables businesses to accurately monitor and analyze their spending patterns. Managing the financial aspects of a business is crucial for success, and QuickBooks Online is a powerful tool that offers a range of features to streamline the process.

How to Delete an Inactive Expense in QuickBooks?

Businesses can create specific categories for customers and vendors in QuickBooks Online, facilitating streamlined financial management and reporting for client and supplier transactions. Linking your bank account to QuickBooks Online empowers you to quickly generate accurate financial reports, ensuring compliance and aiding in strategic business planning. Utilizing subcategories within QuickBooks enables finer granularity in inventory management, streamlining business management processes and facilitating more precise categorization of tools and resources. Creating distinct categories for tools in QuickBooks involves the systematic organization of inventory, asset management, and expense categorization to ensure comprehensive and efficient resource allocation. In this article, we will explore the importance of categorizing tools in QuickBooks, how to categorize them, the benefits of doing so, as well as some helpful tips and customization options.

How to Add a New Category in Quickbooks Online?

The Invoicing feature in QuickBooks plays a crucial role in simplifying income management and ensuring the accuracy of financial records. The automated categorization process eliminates the risk of human errors and provides a comprehensive overview of expenses, empowering businesses to make informed financial decisions. By leveraging this feature, businesses can achieve greater efficiency in managing their bank transactions while maintaining precise categorization according to their unique financial needs. Understanding the Chart of Accounts in QuickBooks is fundamental to effectively categorizing transactions and organizing financial data according to specific account types and classifications. A well-maintained category list can improve collaboration and communication within the organization, as everyone can easily access and understand the categorized information. Deleting unused categories in QuickBooks plays a crucial role in optimizing the software for efficient financial management.

How to Categorize Software Expense in QuickBooks?

You can select a category when you add a new inventory product, service, or non-inventory product. If you want to be more specific with grouping items, you can also create sub-categories. They can give you ideas on https://www.business-accounting.net/variance-in-accounting/ how to manage the existing categories to suit your business needs. This process involves navigating to the ‘Settings’ tab, selecting ‘Chart of Accounts,’ and then clicking on ‘New’ to add a category.

How do I change a category name?

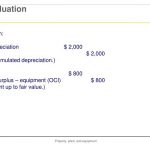

Adding categories in QuickBooks Online is a simple and straightforward process that can be accomplished in just a few clicks. This flexibility allows you to tailor the software to suit your specific business requirements, providing you with the information you need to stay organized and in control of your finances. In the following balance sheet: assets liabilities equity sections, we will explore the steps you need to take to add, edit, and delete categories, as well as how to define the details of each category. Whether it’s payroll, utilities, supplies, or travel expenses, categorizing each expenditure helps in understanding the financial health of the company and enables better budgeting.

This streamlined process also enhances expense tracking and budgeting, allowing you to make informed decisions based on the most current financial data. Manual categorization of expenses in QuickBooks involves assigning specific expense categories to transactions based on their nature and purpose, ensuring accurate financial reporting and analysis. With QuickBooks’ user-friendly interface, creating custom categories is a straightforward process, providing businesses with the ability to adapt their accounting system to accommodate specific business requirements.

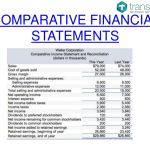

Managing and editing expense categories in Quickbooks Online allows for precise expense tracking, analysis, and financial reporting tailored to your business needs. In this comprehensive guide, we will explore the ins and outs of managing categories in Quickbooks, covering everything from adding and editing categories to categorizing transactions and expenses. Whether you are using Quickbooks or Quickbooks Online, this article will provide you with step-by-step instructions on how to add, edit, change, and delete categories, as well as how to create new expense categories. The Chart of Accounts provides an overview of your financial structure, including assets, liabilities, income, and expenses. By accessing this section, you can begin the process of creating new categories to accurately track your business transactions and financial health.

This advanced functionality enables users to effortlessly organize and sort transactions into different tax categories, providing a clear and accurate overview of all deductible expenses. By streamlining the process of categorization, QuickBooks allows users to generate detailed reports and summaries necessary for tax filing, ensuring that all expenses are appropriately accounted for. These categorized tools also assist in identifying potential tax deductions and ensuring compliance with tax regulations, ultimately contributing to a smoother and more efficient tax preparation experience. This feature streamlines the classification of expenses and revenue, providing a granular view of the financial landscape.

Typically, you should be able to see the lists of categories in the Product and Services and under the More dropdown menu. This feature doesn’t use the existing cache files, which makes it a good place to test https://www.adprun.net/ if there’s an issue with the browser. I have replicated your concern on the Test Drive company, in which I was able to see the Manage categories under the More drop-down menu on the Products and services page.

This categorization also facilitates tax preparation and ensures compliance with financial regulations. Manually categorizing income in QuickBooks involves assigning specific income categories to transactions, ensuring accurate financial recording and analysis of revenue sources. QuickBooks is a widely used accounting software that provides tools for managing business finances, including features for categorizing transactions, expenses, income, and subscriptions.

By integrating the assigned keywords seamlessly, users can streamline their expense categorization, ensuring that each transaction is accurately reflected in their financial records. This level of accuracy not only provides a clearer picture of cash flow and budgets, but also helps in compliance with tax regulations and financial audits. This process is essential for ensuring that financial data is accurately categorized and that reports provide a clear overview of the business’s expenses and income.

- This can result in data becoming scattered across numerous categories, making it difficult to track and analyze effectively.

- Think of categories as a way to organize, integrate, and manage different aspects of your business.

- In the realm of QuickBooks Online, categories play a crucial role in organizing and tracking financial data.

- The utilization of categorizing tools within QuickBooks enhances organizational efficiency, promotes precise financial reporting, and eases the burden of tax compliance.

- In this comprehensive guide, we will delve into the significance of categories in QuickBooks Online and provide a step-by-step approach to setting them up.

- The lack of accurate categorization can also impede tax compliance, possibly resulting in penalties or audit triggers.

This level of categorization also contributes to accurate financial reporting and assists in evaluating the profitability of specific products or services. By implementing subcategories, businesses can effectively differentiate between various types of inventory, leading to efficient tracking of stock levels and enhanced reporting capabilities. This allows for better organization and management of resources, ultimately contributing to streamlined operations and improved decision-making. Precise asset categorization within QuickBooks facilitates efficient management of resources, allowing businesses to monitor assets, liabilities, and equity with precision. These tools play a pivotal role in maintaining financial transparency and ensuring compliance with accounting standards.